How to Start Cryptocurrency Trading: A Beginner's Step-by-Step Guide (2025)

Captain Crypto

Captain CryptoListen to This Article

Podcast Episode • 12 min

Quick Answer

To start cryptocurrency trading in 2025: 1) Choose a reputable exchange like Coinbase or Binance, 2) Complete KYC verification and enable 2FA security, 3) Fund your account with $50-100 to start, 4) Begin with spot trading (not margin or futures), 5) Use visual tools like WaveTrader to simplify market analysis, 6) Risk only 1-2% per trade while learning. Success comes from patience, not perfection.

The crypto ocean is swelling again: total market value is back above $3 trillion and new opportunities are breaking like perfect waves on the horizon. Yet for newcomers, jumping into these digital waters can feel like paddling out without knowing how to read the surf.

Markets in 2025 offer bigger swells than ever before. Seasoned wave riders catch these price movements with practiced ease, but beginners often wipe out on the very volatility that creates the best opportunities. How do you catch the swell without getting slammed?

Good news: you don't need to spend years learning to read complex charts. Modern tools like WaveTrader's visual analytics work like having a seasoned surf instructor right beside you—pointing out exactly when conditions are perfect for entry and when to paddle back to safety. No more drowning in technical analysis or second-guessing every market move.

This guide cuts through the foam to show you everything that matters: different ways to trade, setting up your first account, and making moves with confidence. Master these fundamentals and you'll be riding the crypto waves like a pro, one smart trade at a time.

Key Takeaways

- Start with spot trading on established exchanges—avoid leverage until you master the basics

- Security is non-negotiable: enable 2FA, use cold wallets, create dedicated crypto emails

- Risk only 1-2% of your capital per trade while building experience and discipline

- Visual trading tools like WaveTrader translate complex charts into clear buy/sell signals

- Crypto markets run 24/7 with higher volatility than stocks—preparation is everything

Master the Crypto Trading Fundamentals

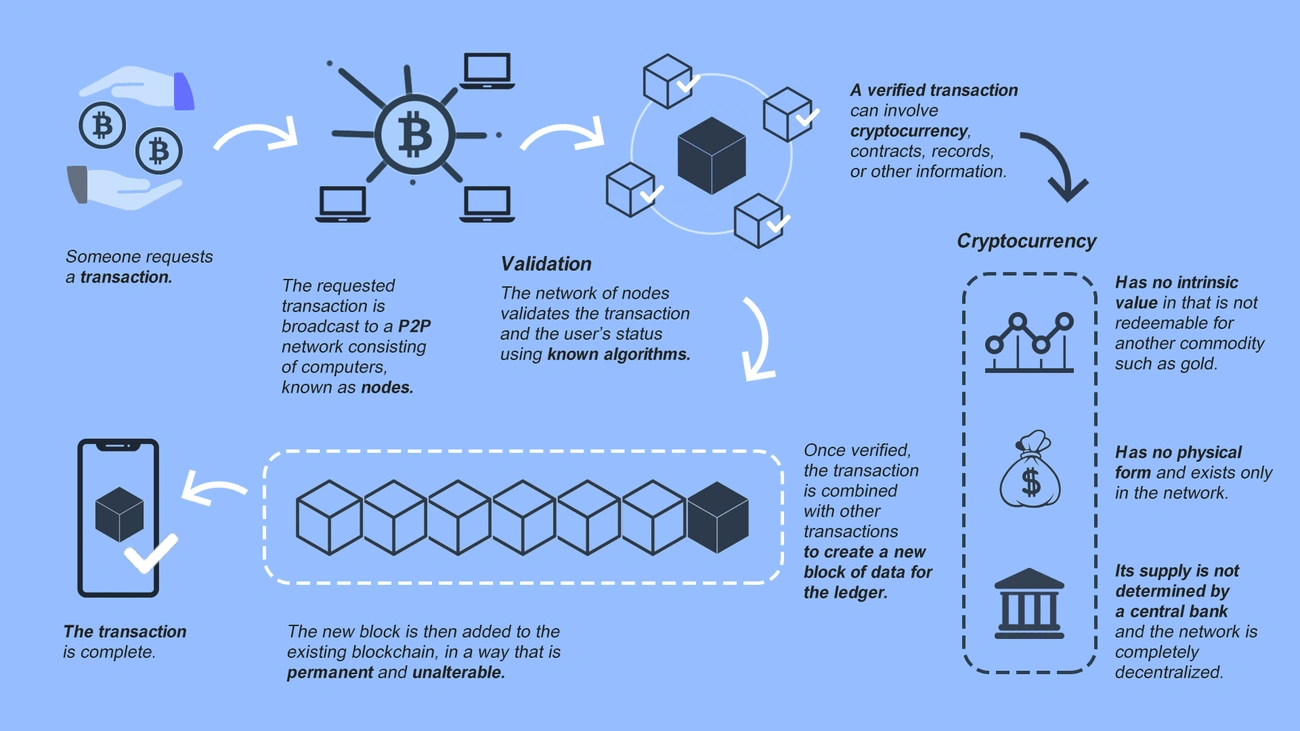

Image Source: Addevice

Crypto markets never sleep. While traditional exchanges close their doors, digital assets keep moving around the clock—creating opportunities that don't wait for business hours.

What is cryptocurrency trading?

Cryptocurrency Trading

The practice of buying and selling digital assets to profit from price movements, either against other cryptocurrencies or traditional currencies (fiat).

Here's how it works:

- Buy low, sell high—the fundamental principle that drives all profitable trading

- Trade directly on blockchain technology, cutting out traditional banking middlemen

- Execute transactions instantly across global markets without geographic limits

Most wave riders start with the big names: Bitcoin (BTC) and Ethereum (ETH). These established coins offer more stability for beginners. Once you've found your balance, altcoins—the thousands of alternative cryptocurrencies—present bigger waves with higher rewards and steeper risks.

WaveTrader cuts through the complexity by showing you exactly when market conditions align for smart entries. No more staring at confusing candlestick charts or trying to decode technical patterns yourself.

Types of crypto trading: spot, margin, futures

Different trading styles suit different risk appetites:

Spot Trading

- Buy actual cryptocurrencies at current market prices

- Own your assets completely—hold them as long as you want

- Perfect for beginners: lower risk, straightforward execution

Margin Trading

- Borrow funds to increase your position size

- Example: $100 with 5x leverage controls $500 worth of crypto

- ⚠️ Warning: Magnifies both gains and losses—not recommended for newcomers

Futures Trading

- Trade contracts based on future price predictions

- Speculate without owning actual cryptocurrencies

- Allows shorting (profiting from price drops)

- Advanced strategy requiring deep market knowledge

Start with spot trading. Master the basics before paddling into deeper waters.

How crypto differs from stock trading

Crypto markets play by different rules:

🕐 Trading Hours

Crypto: 24/7, 365 days a year

Stocks: Limited to exchange hours (9:30 AM - 4:00 PM EST)

📊 Volatility

Crypto: 10-20% daily swings are common

Stocks: Rarely move more than 1-2% per day

💰 Entry Barriers

Crypto: Start with $10-$20 on most platforms

Stocks: Often require higher minimum investments

⚡ Settlement Speed

Crypto: Instant execution and settlement

Stocks: T+2 (takes 2 business days to finalize)

These differences create unique opportunities—but also new challenges. Tools like WaveTrader help beginners navigate this fast-moving environment by translating complex market signals into clear visual cues that anyone can understand.

Success in crypto trading starts with understanding these fundamentals, then building disciplined habits that work in this always-on digital marketplace. For a deeper dive into market analysis basics, check out our beginner's guide to crypto market analysis.

Build Your Trading Foundation

Like any serious surf session, you need solid preparation before hitting the waves. Your trading foundation comes down to three essentials: picking the right platform, setting up bulletproof security, and knowing how to protect your digital assets.

Pick Your Launch Platform

Your choice of exchange is like selecting the right beach—some offer calm conditions perfect for beginners, while others throw you straight into expert-level surf. Coinbase, Binance, and Kraken have earned their reputations as reliable launchpads for new wave riders.

When scouting exchanges, check these critical factors:

- Security track record – Has the platform weathered storms without major breaches?

- Coin selection – Can you trade the assets on your radar?

- Fee structure – Trading costs, withdrawal fees, and deposit charges all matter

- Trading volume – Higher liquidity means smoother price execution

- Interface design – Clean, intuitive platforms prevent costly mistakes

Some exchanges now integrate visual trading tools that turn market complexity into clear signals. Platforms supporting WaveTrader's approach give you instant visual cues about market conditions—no more squinting at confusing charts trying to figure out your next move. Learn more about finding the lowest fee exchanges we tested.

Lock Down Your Account

Strong passwords are your first line of defense. Mix letters, numbers, and symbols into something you've never used before. Most legitimate exchanges also require identity verification through their Know Your Customer (KYC) process.

You'll typically need:

- Government ID (passport or driver's license)

- Address verification (utility bill or bank statement)

- Selfie or video confirmation

Verification can take minutes or days depending on platform traffic. This step protects both you and the broader crypto ecosystem from fraud—think of it as getting your official surf license.

Fortify Your Digital Assets

Two-factor authentication (2FA) is non-negotiable. Skip SMS-based options and go straight to authenticator apps like Google Authenticator or Authy—they're much harder to compromise.

Understanding wallet types is crucial:

Hot Wallets

Internet-connected, perfect for active trading but more exposed to attacks

Cold Wallets

Offline devices like Ledger or Trezor offering maximum security for long-term holdings

Keep only your trading amounts on exchanges. Store larger holdings in cold storage. Create a dedicated email for crypto activities and secure it with 2FA too.

WaveTrader doesn't just simplify your trading signals—it emphasizes security practices right from the start, helping you build habits that protect your capital long-term.

Remember: even the perfect trading strategy can't recover from security failures. Build these safeguards now, before you need them.

Master Your First Paddle Out

Your account is ready, your gear is secured—time to catch your first real wave. These core moves separate weekend surfers from those who actually ride the swells with confidence.

Fund Your Trading Account

Before you can paddle into position, you need fuel in the tank. Most exchanges offer several ways to add funds:

- Bank transfers - slowest (3-5 days) but cheapest fees

- Credit cards - instant but expect 3-5% fees

- PayPal transfers - quick with variable costs

- Crypto deposits - from your external wallet

Most platforms let you start with just $10-$50, perfect for testing the waters. Cards give you instant access, but bank transfers save you money on fees—choose based on whether you want speed or savings.

Decode Trading Pairs and Orders

Every crypto trade works through pairs: BTC/USD means you're trading Bitcoin against dollars, while ETH/BTC trades Ethereum for Bitcoin. The first coin is what you're buying or selling; the second is your payment method.

Order types sound complex but break down simply:

- Market orders - buy/sell right now at current price

- Limit orders - only execute at your chosen price

- Stop orders - trigger when price hits your target

This alphabet soup often drowns beginners in confusion. WaveTrader cuts through the noise with visual cues that show exactly when to place which type of order—no more guessing whether you should set a limit or go with market price. Understanding break signals and trading indicators becomes much simpler with visual tools.

Start Small and Build Your Skills

Your first trades should feel like gentle practice waves, not massive pipeline barrels. Risk only 1-2% of your total funds per trade while you're learning the ropes.

Small positions let you:

- Feel real market action without heart-stopping risk

- Test platform features without costly mistakes

- Build emotional discipline in calm conditions

- Track what works through careful notes

Even seasoned traders get tossed around by sudden volatility. WaveTrader's visual signals help you spot the difference between a rideable swell and dangerous chop, especially crucial during your first months in these fast-moving waters.

Review every trade afterward. What worked? What didn't? Consistent small wins beat the occasional lucky strike every time.

Cut Through the Chart Chaos

Charts packed with candlesticks, moving averages, and indicators like RSI or MACD can make even the most eager newcomer want to paddle back to shore. The good news? Modern tools are flipping the script on how beginners read market signals in 2025.

Why Traditional Charts Intimidate New Traders

The alphabet soup of technical analysis overwhelms most first-timers. You stare at screens filled with squiggly lines, colored bars, and numerical readings—yet none of it tells you when to actually make a move. Sound familiar?

Most beginners hit these same roadblocks:

- Signal vs. noise confusion – Which price movement actually matters?

- Information overload – Too many indicators saying different things

- Entry/exit paralysis – Hours of analysis, zero confident decisions

- Opportunity blindness – Missing obvious setups while overthinking

Like trying to surf in fog, traditional chart reading leaves you guessing where the next wave will break.

WaveTrader: Your Market Translator

Here's where WaveTrader changes the game completely. Instead of forcing you to decode complex charts, it translates market movements into crystal-clear visual signals:

- 🏄 Paddle Zones – Green highlights show optimal entry points

- 🌊 Wipeout Zones – Red alerts warn of potential reversals

- 📈 Trend Swells – Visual waves show momentum direction

- ⚡ Real-time Alerts – Instant notifications when opportunities surface

Think of WaveTrader as your personal wave spotter—scanning the entire ocean while you focus on the perfect ride. No more analysis paralysis or missed opportunities because you couldn't read the charts fast enough. See how our visual analytics approach transforms complex data into actionable insights.

Essential Tools Every Wave Rider Needs

- TradingView – Customizable charts where you can compare your moves with seasoned traders

- CoinMarketCap – Market overview to understand what's driving the bigger waves

- Fear & Greed Index – Emotional temperature of the market (when everyone's greedy, time to be careful)

- Portfolio Trackers (Delta, CoinStats) – Monitor your positions across different exchanges

Remember: these tools work best together, not as replacements for market understanding. WaveTrader handles the complex analysis while you build knowledge through actual trading experience.

Master the visual signals first, then expand your toolkit as confidence grows.

Don't Get Caught in These Riptides

Even seasoned surfers get tumbled by unexpected waves. Yet newcomers face the biggest wipeouts—often losing their entire board (and savings) to mistakes that could have been avoided. Spot these dangerous currents before they pull you under.

Getting swept up by FOMO currents

Fear of missing out hits like a powerful riptide. You see a coin shooting upward and every instinct screams "paddle faster!"—but chasing these late-breaking waves usually means buying right before the crash. Watching others ride perfect swells while you sit on the beach? That stings.

WaveTrader cuts through the emotional chop with objective signals that separate genuine opportunities from fool's gold. When the crowd goes wild, you'll see clearly whether it's time to paddle in or stay patient on shore.

Ignoring the safety rules

Most beginners wipe out because they skip basic ocean safety. Smart wave riders always:

- Set stop-loss orders before entering any position

- Risk only 1-2% of their capital per trade

- Avoid leverage until they've mastered the basics

WaveTrader's visual risk alerts work like a surf buddy watching your back—flashing red when you're pushing too hard into dangerous territory.

Paddling frantically without direction

New traders often exhaust themselves chasing every ripple, jumping from coin to coin without any game plan. This frantic paddling burns energy while going nowhere. Worse, all those transaction fees add up like barnacles on your board.

Quality beats quantity in both surfing and trading. Wait for the right conditions, make your move with purpose, then ride it through. WaveTrader's clean interface helps you spot those perfect moments instead of getting distracted by market noise.

Missing the weather reports

Crypto markets shift as fast as ocean storms. Regulatory news, tech updates, and global events create massive swells—yet many beginners trade blindly, ignoring the forecast entirely.

Stay plugged into reliable news sources and market updates. When major waves are building, WaveTrader highlights which movements align with real catalysts versus random chop, helping you distinguish signal from noise.

Frequently Asked Questions

How much money do I need to start cryptocurrency trading?

You can start cryptocurrency trading with as little as $10-$50 on most major exchanges. However, we recommend starting with $100-$500 to have enough capital to diversify your positions and cover transaction fees. Remember to only invest what you can afford to lose, especially while learning.

Is cryptocurrency trading safer than stock trading?

Cryptocurrency trading generally carries higher risk than stock trading due to greater volatility (10-20% daily swings vs 1-2% for stocks), less regulation, and 24/7 markets. However, crypto offers unique advantages like instant settlement, lower entry barriers, and global accessibility. Success comes from proper risk management regardless of the market.

What's the difference between hot and cold wallets?

Hot wallets are connected to the internet and ideal for active trading—think of them as your checking account. Cold wallets are offline hardware devices (like Ledger or Trezor) that store crypto securely for long-term holding—like a savings vault. Keep trading funds in hot wallets, but store larger holdings in cold storage for maximum security.

How does WaveTrader simplify crypto trading for beginners?

WaveTrader transforms complex market data into visual surf metaphors that anyone can understand. Instead of decoding candlestick charts, you see Paddle Zones (green) for buying opportunities and Wipeout Zones (red) for sell signals. The app provides real-time alerts and clear visual cues, eliminating the analysis paralysis that stops most beginners.

Should I start with Bitcoin or altcoins?

Begin with established cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) as they offer more stability and liquidity for beginners. These 'blue chip' cryptos have proven track records and are less prone to extreme volatility. Once you've mastered the basics and built confidence, you can explore altcoins which offer higher risk/reward potential.

Start Paddling

The crypto waves keep rolling, and now you know how to read them. You've got the foundation: secure exchanges, smart trading steps, and visual tools that cut through market complexity. Most importantly, you understand that success comes from patience, not perfection.

Small trades build big skills. Every position you take teaches something new about market rhythm and your own decision-making. WaveTrader's visual cues help you spot the good swells while avoiding the wipeouts that catch beginners off-guard.

Risk management isn't optional—it's what separates surfers from swimmers. Stop-losses, position sizing, and emotional discipline keep you riding waves instead of getting tumbled by them. Even the best wave riders respect the ocean's power.

The crypto market never sleeps, which means new opportunities appear every day. Stay curious about regulatory changes and tech developments. Combine this knowledge with disciplined practice and you'll see your trading instincts sharpen over time.

Here's the truth: you won't nail every trade. Pros don't either. What matters is building consistent habits, learning from each session, and using tools that make complex signals simple to understand.

You've got the knowledge. You've got the tools. The next perfect wave is forming right now.

Time to paddle out.

Trading Terms Glossary

FOMO (Fear of Missing Out)

The emotional impulse to buy into a rapidly rising asset for fear of missing potential profits, often leading to poor entry timing.

KYC (Know Your Customer)

Identity verification process required by exchanges to comply with regulations and prevent fraud.

2FA (Two-Factor Authentication)

Security feature requiring two forms of identification to access your account, typically a password plus a code from an authenticator app.

Stop-Loss Order

An automatic sell order that triggers when an asset falls to a predetermined price, limiting potential losses.

Ready to Ride?

The waves are rising and the water's warm. Grab your digital board and join thousands of new traders already lining up for the drop.

Sign up for the WaveTrader waitlist today at WaveTrader.net and turn complex crypto analytics into a breezy day at the beach. 🌊🏄♂️

Join the Waitlist →Share this wave:

Captain Crypto

Surf instructor turned crypto educator. Helping traders ride the market waves with confidence.

Catch the Next Wave

Why Most Traders Pick the Wrong Stock Entry Point (And How to Fix It)

Discover why 90% of retail traders crash on entry timing and learn institutional strategies to find high-probability stock entry points. Master killzones, breakout-retest setups, and overcome the psychology that sinks accounts.

The Secret Swing Trading Pattern That Made Me $50K in Crypto

Discover the exact swing trading pattern that generated $50K in a single Bitcoin trade. Learn the indicators, timing, and risk management strategies that work in both bull and bear markets.

Riding the Crypto Market Waves: A Beginner's Guide to Market Analysis

If you're new to cryptocurrency trading, the charts and data can feel intimidating at first. Learn how to understand market analysis with visual tools and surf analogies.