Quick Answer

Starting January 2025, the IRS requires crypto exchanges to report your transactions on Form 1099-DA. You'll need to use wallet-by-wallet accounting instead of the universal method. Short-term gains (crypto held ≤1 year) are taxed at 10-37%, while long-term gains (>1 year) are taxed at 0-20%. Every sale, trade, or purchase with crypto is a taxable event.

The rules for taxing crypto gains will soon see a complete makeover. U.S. cryptocurrency exchanges must track and report your transactions on Form 1099-DA starting January 2025. This new tax form was created just for digital assets. These changes will affect how you calculate and report your crypto profits to the IRS – just like tracking waves affects your surfing strategy.

Brokers like Coinbase will have to report your crypto sales and exchanges' gross proceeds from 2025 onwards. This change will transform cryptocurrency tax reporting completely. Right now, investors can use the universal accounting method to calculate cost basis. But the rules will change on January 1, 2025. You'll need to switch to a wallet-by-wallet method instead. These updates will make filing tax returns easier while ensuring accurate reporting.

Your cryptocurrency tax rate depends on how long you keep your assets. The IRS taxes short-term gains from crypto held under a year at regular income rates between 10-37%. However, crypto held longer than a year qualifies for lower long-term capital gains rates of 0-20%. Here's some good news - you won't pay any Capital Gains Tax on long-term gains if your total income, including crypto gains, stays below $47,026.

This piece covers everything about the 2025 IRS rules for crypto taxation. You'll learn what makes crypto taxable and how to calculate gains correctly with the new wallet-by-wallet method. We'll also show you the right way to report crypto activities on your tax return. Together, we'll make these new regulations clear and help you prepare for the upcoming changes.

🔑 Key Takeaways

- Form 1099-DA launches in 2025: Exchanges must report all your crypto transactions to the IRS starting January 2025

- Wallet-by-wallet accounting required: Track each wallet separately instead of using the universal method

- Holding period matters: Keep crypto >1 year for lower tax rates (0-20% vs 10-37%)

- Every trade is taxable: Selling, trading, or buying with crypto creates a tax event

Understanding Crypto Tax Basics

The IRS has specific rules about how it taxes cryptocurrency. You need to know these basics before you can figure out what you owe on your crypto gains – think of it as learning the wave patterns before paddling out.

What makes crypto taxable?

Your crypto becomes taxable with certain transactions. Buying or holding cryptocurrency won't trigger IRS taxes – it's like watching the waves from the beach. But selling, trading, or using your digital assets will have tax implications – that's when you're actually riding the wave.

Two main types of taxes apply to cryptocurrency:

Capital Gains Tax: You pay this when you profit from disposing of cryptocurrency. This includes selling crypto for regular money, trading one cryptocurrency for another, or buying things with crypto. Tax rates vary - up to 37% for short-term gains (held less than a year) and 0% to 20% for long-term gains (held more than a year).

Income Tax: This kicks in when you receive new cryptocurrency. This could be from mining rewards, staking rewards, airdrops, or payments for goods or services. The IRS taxes these at your regular income tax rate.

Note that moving crypto between your own wallets isn't taxable. You can also give crypto as a gift (up to $18,000 per recipient in 2024 and $19,000 in 2025) without tax implications.

Cost Basis

The original purchase price of your cryptocurrency plus any fees paid to acquire it. This is your starting point for calculating gains or losses when you sell – like marking your position on the wave before you drop in.

How the IRS classifies digital assets

The IRS defines digital assets as "any digital representation of value recorded on a cryptographically secured, distributed ledger". Cryptocurrencies might work like money sometimes, but the IRS treats them as property - just like stocks or real estate. For traders using visual tools to analyze markets, this classification affects how you track and report transactions.

This means:

- • Property tax rules apply to all transactions

- • You must track your original purchase price

- • You figure out gains or losses when you sell

- • Your holding period determines your tax rate

These rules apply to:

- 🪙 Convertible virtual currencies and cryptocurrencies (Bitcoin, Ethereum, etc.)

- 🪙 Stablecoins pegged to fiat currencies

- 🪙 Non-fungible tokens (NFTs)

Your tax return must show whether you received, sold, exchanged, or handled any digital assets during the tax year.

Why 2025 rules are different

The tax landscape changes on January 1, 2025, with Form 1099-DA (Digital Asset Proceeds from Broker Transactions). This new form creates standard reporting requirements for crypto transactions. It fixes problems with inconsistent reporting and lack of third-party verification.

The biggest changes include:

Mandatory broker reporting:

Places like Coinbase must tell both you and the IRS about your crypto sales and exchanges.

Wallet-by-wallet accounting:

You'll need to track each wallet separately instead of using the "universal method" for cost basis.

Phased implementation:

The 2025 reports will show only gross proceeds. Cost basis reporting starts in 2026, making it easier to calculate gains and losses.

The IRS made these changes to boost transparency and tax compliance while closing gaps in unreported crypto income. A good portfolio tracking app can help you make smart trading decisions and keep accurate tax records.

These rules are part of a worldwide push to standardize crypto taxation, as many countries create similar reporting frameworks.

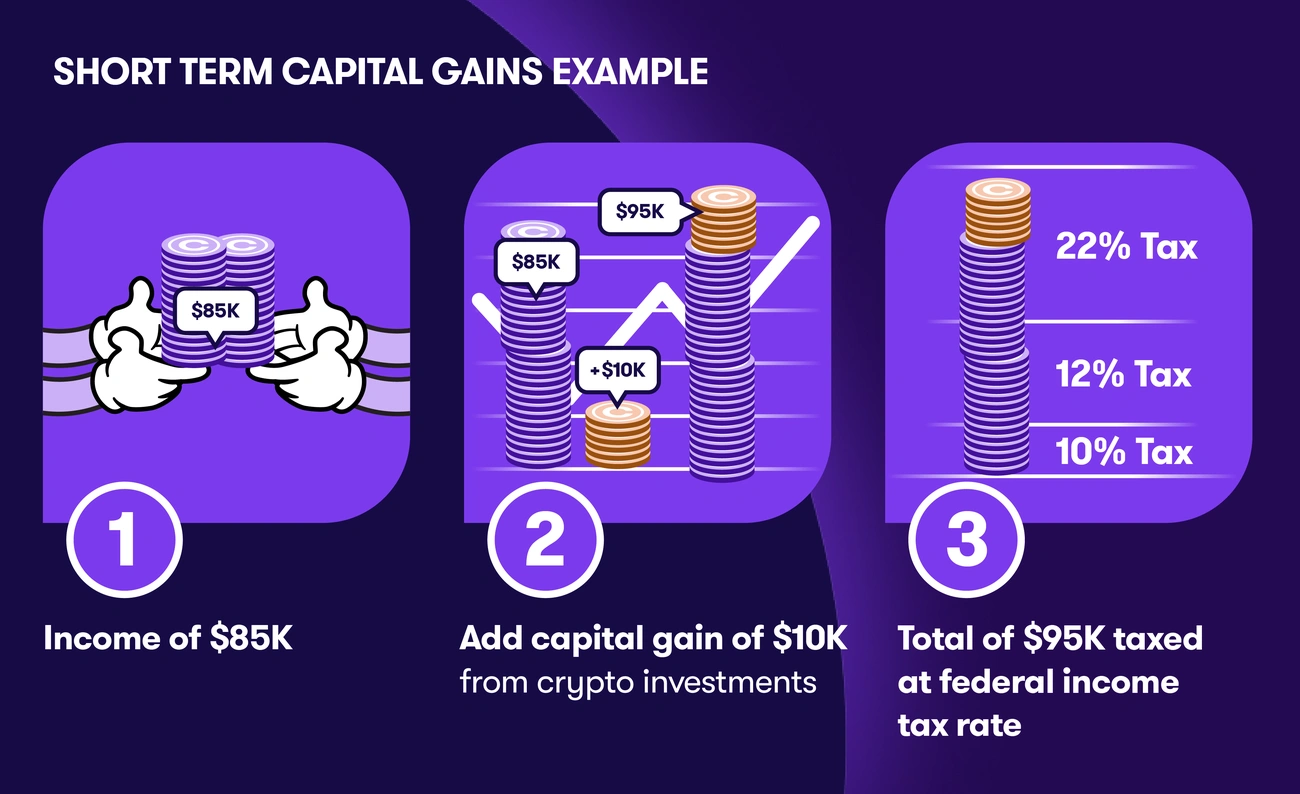

Types of Taxes on Crypto Gains

Image Source: Crypto Tax Calculator

Image Source: Crypto Tax Calculator

You need to know about two main types of taxes that apply to your crypto activities. Your tax obligations will vary based on how you use cryptocurrency – just like how different waves require different surfing techniques.

Capital gains tax on cryptocurrency

The IRS looks at cryptocurrency as property, like stocks or real estate. This means you'll pay capital gains tax when you sell or trade crypto at a profit. The tax applies to the difference between what you paid (cost basis) and what you sold it for.

You'll face capital gains tax in these cases:

- 💰 Selling crypto for regular money (like USD)

- 🔄 Trading one cryptocurrency for another

- 🛒 Buying things with cryptocurrency

To cite an instance, see what happens if you bought Bitcoin at $30,000 and sold it at $40,000 - you'd owe tax on that $10,000 profit. The WaveTrader app helps you make smarter trading decisions – showing you when you're in the "paddle zone" (good entry) versus the "wipeout zone" (potential loss).

Capital Gains Tax

A tax on the profit you make when selling an asset for more than you paid for it. In crypto, this applies whenever you sell, trade, or use your digital assets. Think of it as the IRS taking a cut of your successful wave rides.

Income tax from mining, staking, and rewards

Beyond capital gains, crypto you receive through other activities might trigger income tax. The IRS wants you to report the market value of any crypto on the day you got it as regular income. This is different from capital gains – it's like getting paid for being a surf instructor versus selling your surfboard for a profit.

These activities create income tax obligations:

Mining rewards:

The IRS taxes crypto from mining as regular income based on its value when you receive it. Miners who run it as a business can report earnings on Schedule C and deduct business costs.

Staking rewards:

The tax rules work just like mining - you'll pay income tax when you receive staking rewards. The crypto's value that day becomes your starting point for future capital gains.

Payment for services:

Getting paid in crypto? You must report its market value as income right when you receive it.

Short-term vs long-term gains

Your crypto tax rate changes based on how long you hold onto it – patience pays off in both surfing and crypto:

Short-term Capital Gains

Crypto held ≤ 1 year

This applies to crypto you sell within a year. The tax rate matches your regular income tax bracket.

Long-term Capital Gains

Crypto held > 1 year

Hold crypto longer than a year and you'll benefit from better tax rates that are much lower than short-term rates.

Let's say you're in the 22% tax bracket. You'd pay that rate on crypto you sell quickly. But if you wait over a year, you might only pay 15% or even nothing if your income stays below certain levels. For traders using break signals and trading patterns, timing your exits can significantly impact your tax bill.

The good news? Crypto losses can offset your gains and up to $3,000 of regular income each year. Any extra losses roll over to future years – like wiping out on a wave but getting back on your board stronger.

What Crypto Transactions Are Taxable in 2025

The IRS will maintain cryptocurrency's classification as property through 2025, which means you'll need to pay taxes on various transactions. You should know which activities create tax events to ensure accurate reporting – it's like knowing which waves are worth catching and which ones to let pass.

Selling crypto for fiat

Every time you sell cryptocurrency for dollars or other fiat currency, you create a tax event. The IRS sees this as an asset disposal that's subject to capital gains tax. You must report these transactions regardless of profit or loss. Your tax rate depends on how long you've held the asset - keeping it over a year qualifies you for lower long-term capital gains rates.

Trading one crypto for another

The IRS treats crypto-to-crypto exchanges (including stablecoins) as taxable events, even without fiat currency involvement. They look at these trades as if you sold your first crypto for dollars and bought the second crypto with those dollars. A Bitcoin to Ethereum trade, for example, creates a capital gain or loss based on Bitcoin's value at the time of exchange compared to your purchase price. This is crucial for traders who frequently switch between different cryptocurrencies while analyzing market patterns.

Using crypto to buy goods or services

Your cryptocurrency purchases trigger tax events. The IRS calls it an asset disposal whether you buy a pizza or a car. You'll need to calculate the difference between your crypto's value at purchase time and your original cost. This difference becomes your reportable capital gain or loss – like cashing out your surf session early to grab lunch on the beach.

Receiving crypto as income

The IRS taxes crypto payments for work, services, or goods as ordinary income. This includes:

- 🌊 Wages or salary paid in cryptocurrency

- 🌊 Payments for freelance or contract work

- 🌊 Earnings from selling goods

You should report the cryptocurrency's fair market value on your receipt date. These transactions appear on different tax forms than your capital gains.

Tax Event

Any cryptocurrency transaction that triggers a tax obligation. This includes selling, trading, or using crypto to buy things. Moving crypto between your own wallets is NOT a tax event – that's just paddling to a different spot on the same wave.

Airdrops and staking rewards

The 2025 tax rules split airdrops into two categories: consent-based airdrops that are taxed when claimed, and unsolicited airdrops taxed only at sale. This changes the previous approach where all airdrops faced taxation upon receipt.

Staking rewards get updated treatment in 2025. The IRS wants to tax these rewards only after sale instead of upon receipt. Notwithstanding that, businesses offering staking services might face different classifications, and their rewards could count as business income.

Note that accurate transaction tracking becomes vital as the new Form 1099-DA reporting starts in 2025. Exchanges will report your crypto sales directly to the IRS. When choosing between different exchanges, consider their tax reporting features alongside their fees.

How to Calculate Tax on Crypto Gains

Proper documentation and a step-by-step approach are needed to calculate your crypto tax gains. The 2025 IRS rule changes make it significant to understand the right calculation methods – like reading the waves before you paddle out.

Determine your cost basis

Your cryptocurrency's cost basis equals its original purchase price plus any acquisition fees. A good example shows that buying 1 ETH at $1,500 with a $50 transaction fee gives you a cost basis of $1,550. The right cost basis calculation significantly affects your tax liability. Different ways of getting crypto create unique cost basis scenarios:

- 🏄 Purchased crypto: Purchase price plus fees

- 🏄 Mined or staked: Fair market value on date received

- 🏄 Gifts: Original owner's cost basis (with exceptions)

- 🏄 Airdrops: Fair market value on date claimed

Calculate your capital gain or loss

The math to figure out your gain or loss is straightforward. Just subtract your cost basis from the sale price after removing selling fees. Here's the simple formula:

Capital Gain/Loss = Proceeds - Cost Basis

To name just one example, selling 1 BTC at $60,000 that you bought for $33,660 results in a $26,340 capital gain – that's a successful ride on a big wave!

Use wallet-by-wallet accounting method

The IRS requires wallet-by-wallet accounting starting January 1, 2025. This new rule means:

- 📍 Each wallet or exchange account needs separate cost basis tracking

- 📍 You can't use one accounting method for all wallets anymore

- 📍 Every transaction must connect to its specific source

- 📍 You get a one-time chance to redistribute unused basis across wallets by January 1, 2025

These changes match the broker reporting requirements on the new Form 1099-DA.

Wallet-by-Wallet Accounting

The new 2025 IRS requirement to track cost basis separately for each cryptocurrency wallet or exchange account. You can no longer pool all your crypto together for tax calculations – each surf break (wallet) needs its own logbook.

Track holding periods for tax rates

Your tax rate depends on how long you hold your crypto:

⚡ Short-term Capital Gains

Held ≤ 1 year

*2025 rates for single filers

🌴 Long-term Capital Gains

Held > 1 year

💡 Pro Tip

Hold for over a year to potentially save 17% or more on taxes!

*2025 rates for single filers

Quick Tax Comparison

Short-term (≤1 year)

10% - 37%

Long-term (>1 year)

0% - 20%

Knowing when you bought each crypto asset helps minimize your tax bill. Think of it like waiting for the perfect wave – patience often pays off.

Crypto tax calculators and tools

Specialized software tools are a great way to get help with complex crypto tax calculations:

- ✅ Import transactions from exchanges and wallets automatically

- ✅ Work out gains/losses using different accounting methods

- ✅ Create tax forms including Form 8949 and Schedule D

- ✅ Monitor cost basis across multiple wallets

These tools help you follow the new wallet-by-wallet rules and might find ways to save on taxes. For beginners just starting their crypto journey, using tax software from day one can save headaches later.

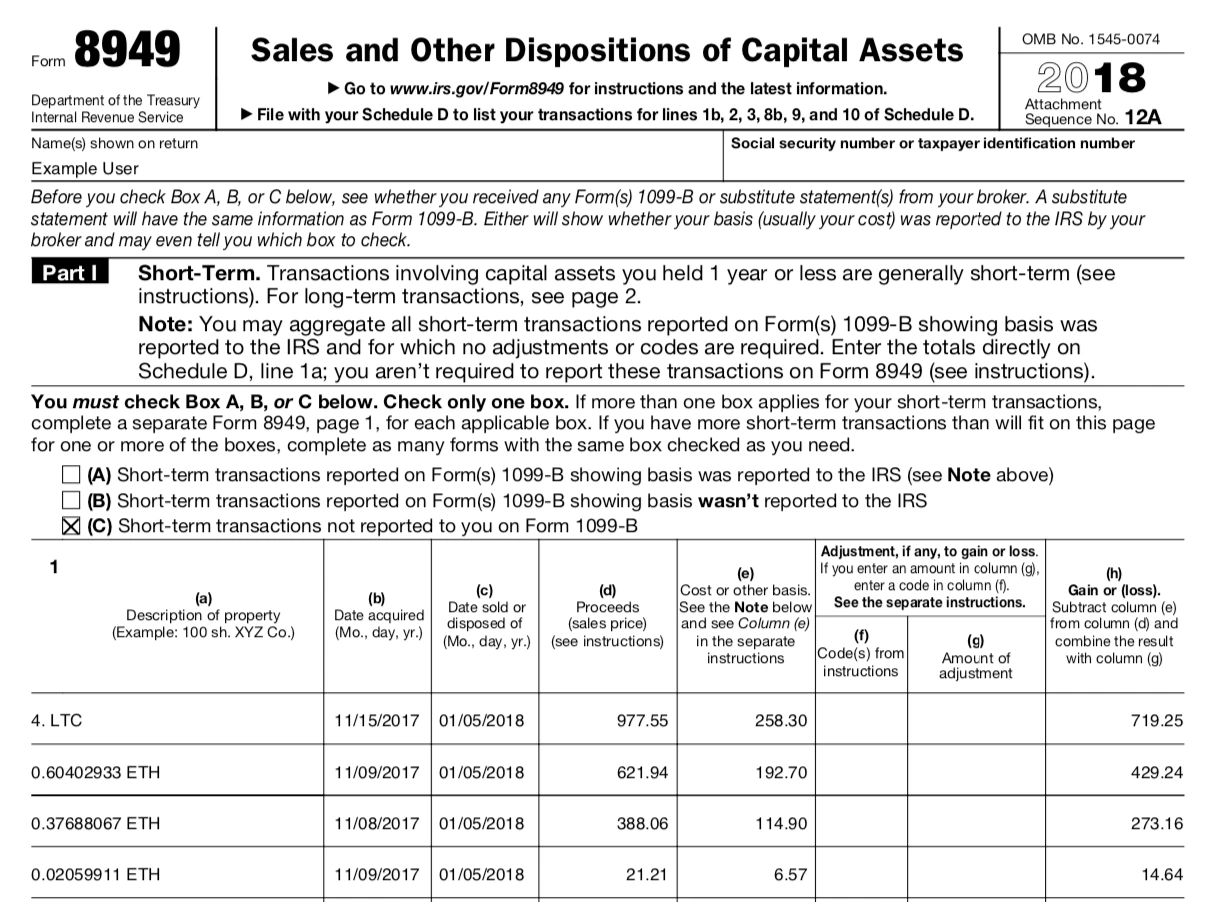

How to Report Crypto on Your Tax Return

Image Source: Taxbit

Image Source: Taxbit

Tax returns need accurate reporting of your crypto transactions to comply with IRS regulations. Each crypto activity needs specific forms and proper documentation – like filling out your surf logbook after each session.

Form 8949 and Schedule D

Form 8949 lets you detail every crypto sale or exchange transaction. The form needs a description, acquisition date, sale date, proceeds, cost basis, and gain/loss for each disposal. The totals from Form 8949 go to Schedule D. You must file these forms whatever 1099 forms you get from exchanges.

Reporting income on Schedule 1 or C

Schedule 1 is where you report income from mining, staking, or other crypto rewards. If you earn crypto as an independent contractor or through business, Schedule C is your form. Your self-employed crypto activities that earn more than $400 need Schedule SE to calculate self-employment tax.

Understanding Form 1099-DA

Crypto exchanges must issue Form 1099-DA starting 2025. The original form will only show gross proceeds from sales. Cost basis information becomes part of the form in 2026. Brokers need to track transactions using wallet-by-wallet accounting during this change. You still need to check if this form is accurate – don't just trust the numbers like you wouldn't trust a weather report without checking the actual waves.

Common mistakes to avoid

Small transactions need reporting - every crypto transaction counts, even that $5 coffee bought with Bitcoin. Transaction fees matter when calculating cost basis. Exchange-provided information needs verification. Detailed records of all transactions help ensure compliance. Think of it as keeping a detailed surf journal – every session counts toward your progression.

🤔 Frequently Asked Questions

Do I need to report crypto if I only bought and held?

No, simply buying and holding cryptocurrency is not a taxable event. You only need to report when you sell, trade, or use crypto. However, you must still answer "Yes" to the digital asset question on your tax return if you own crypto. It's like paddling out but not catching any waves – no action, no tax!

What happens if I don't report my crypto taxes?

The IRS can impose penalties ranging from 20% for accuracy-related issues to 75% for fraud. With Form 1099-DA starting in 2025, exchanges will report directly to the IRS, making it harder to avoid detection. Interest also accrues on unpaid taxes. It's better to report and potentially owe nothing than risk penalties later.

Can I use crypto losses to reduce my taxes?

Yes! Crypto losses can offset your crypto gains dollar-for-dollar. If losses exceed gains, you can deduct up to $3,000 against ordinary income. Any remaining losses carry forward to future years. This strategy, called tax-loss harvesting, is like turning a wipeout into a learning experience that benefits you later.

How does staking affect my taxes in 2025?

Under proposed 2025 rules, staking rewards may be taxed only when sold rather than when received. However, if you run staking as a business, rewards could count as business income. The value when you receive rewards becomes your cost basis for future capital gains calculations. Track everything carefully!

Do I need special software for crypto taxes?

While not required, crypto tax software makes compliance much easier, especially with the new wallet-by-wallet accounting rules. These tools can import transactions from multiple exchanges, calculate gains/losses, and generate IRS forms. For active traders or those using multiple platforms, software is highly recommended.

Riding the Tax Wave: Final Thoughts

The 2025 cryptocurrency tax regulations will bring major changes that need your attention. The IRS requires you to report all crypto transactions - whether you sell, trade, or buy. The new wallet-by-wallet accounting method will change how you track and calculate your gains and losses – like learning to read different break patterns at various surf spots.

Your holding period affects your tax rates. Keeping crypto assets for more than a year can lower your tax burden through long-term capital gains rates. Any crypto you receive from mining, staking, or as payment counts as ordinary income and needs reporting as required. For those using trading signals and technical analysis, timing your trades becomes even more important.

Good record-keeping protects you from audits and penalties. The WaveTrader app guides your buy and sell decisions. This matters even more now that exchanges will report your activities through Form 1099-DA.

You need to be proactive about tax compliance. The right forms, correct cost basis calculations, and complete transaction reporting are essential - no matter the size. The 2025 changes will standardize reporting, but you're still responsible for accurate tax filings. Learning these regulations and setting up strong tracking systems now will help you avoid stress during tax season.

Remember: The crypto tax landscape is evolving rapidly, but staying informed and organized will keep you riding the waves successfully. Whether you're a day trader catching quick breaks or a long-term holder waiting for the perfect set, understanding your tax obligations is crucial for maximizing your crypto profits.